Intro of Erie Insurance Summersville WV auto policies

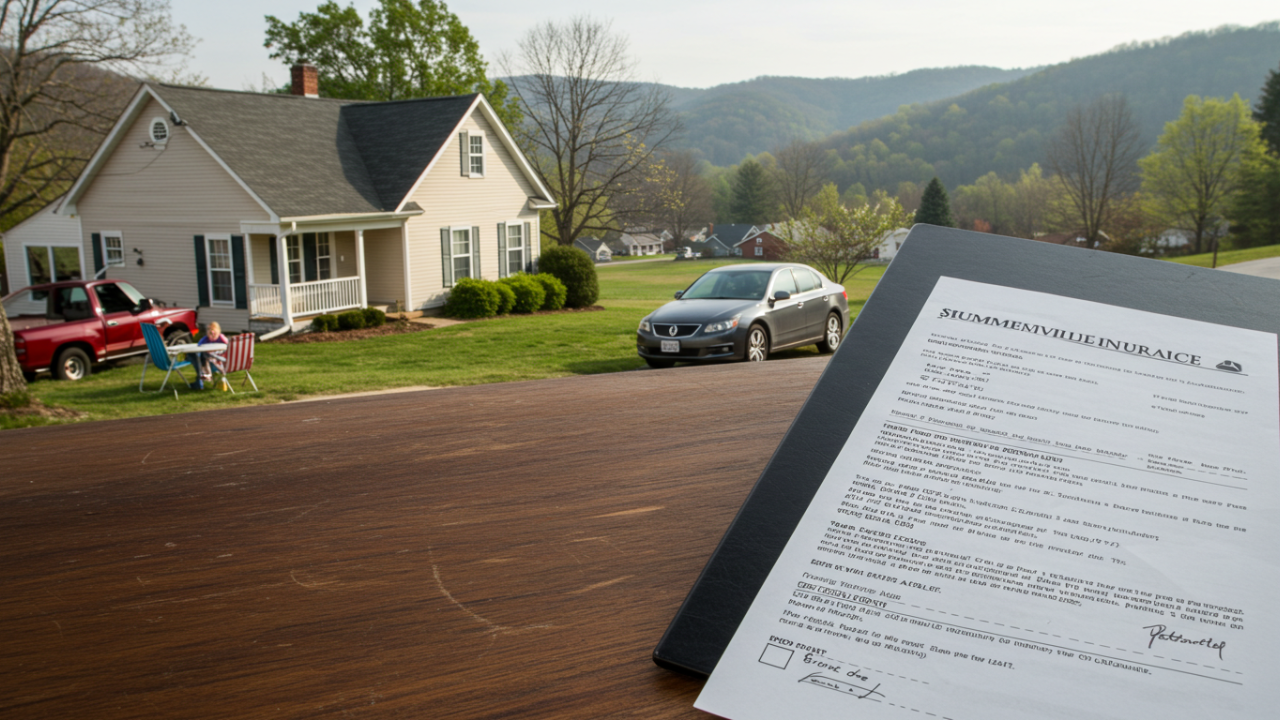

Finding an auto insurance policy that best suits you can prove to be difficult, especially because you have to juggle discounts and premiums all at once. Erie Insurance, which is a highly regarded provider operating out of Summersville, WV, has a plethora of auto policies suited for almost every need.

In this article, I take you through the Erie Insurance’s policies and guides, how to get a quote, and the best reasons why residents of Summersville prefer Erie insurance’s policies if you are a new driver or an individual looking to switch your insurance policies.

The Benefits of Choosing Erie Insurance in Summersville, WV

Trusted Insurance Provider

Summersville residents trust Erie Insurance as their go-to provider for economical and dependable insurance coverage because of how they have serviced the industry for years. For example, Pennsylvania is home to Erie Insurance, which is one of U.S., most reputable insurance companies including Summersville, WV.

It is known for its customer service and competitive pricing. Erie Insurance stands out among others in that they prioritize customer satisfaction and the speed at which they handle claims which has also earned it the motto “Cut your Rates, Keep Your Coverage”.

Wide Range of Coverage Options

Erie Insurance provides a wide variety of insurance products covering everything from personal to business needs. They have auto insurance options that allow you to only pay for the coverage you need.

- Liability Coverage: Erie will pay for the damages and injuries to other parties if you are liable for them in an accident due to Erie’s liability coverage.

- Collision Coverage: Regardless of the liable party, this coverage protects your vehicle if you are involved in an accident.

- Comprehensive Coverage: Theft, vandalism, hailstorms and any other natural disasters are not considered collisions but will still harm your vehicle. This option protects you against such damages.

- Uninsured Motorist Coverage: If an underinsured or uninsured motorist hits you, this coverage takes care of you.

Independent Insurance Agency Benefits

As Erie has independent insurance agents working for them, you can receive quality service while still having the freedom to pick from several options. Summersville independent agents help you with policy coverage tailored to your requirements.

By working with these agents, Erie is able to conveniently provide you with proper assistance after analyzing your specific needs.

Understanding Erie Insurance Auto Policies

Types of Auto Insurance Coverage Offered

Erie Insurance provides multiple protective plans which serve to shield you and your vehicle. A summary of the pertinent policies is outlined below:

Liability Coverage

Liability insurance is a must-have, especially in states like West Virginia, where it is legally required. Liability coverage pays for the damages and injuries you cause to others in an accident. Erie offers liability coverage for both bodily injury and property damage.

- Bodily Injury Liability: This pays for medical bills, loss of income and attorney’s fees incurred by other parties if you meet with an accident.

- Property Damage Liability: This covers damage done to another person’s property like the person’s car or a fence.

Erie’s coverage of these liabilities goes beyond what the state requires which ensures that you have more comfort should an accident occur.

Collision Coverage

Erie Insurance Services boasts of having some of the lowest rates in the state for collision coverage. Collision insurance helps pay for the repair of your car regardless of whose fault it is. This is very helpful for new cars and other extremely costly vehicles. If you’re worried about being left with a massive repair bill after an accident, Erie has your back with their collision coverage.

Comprehensive Coverage

The auto coverage protects your vehicle against non-collision events, such as theft or vandalism. Damage from hail and flooding is also included under comprehensive insurance which is vital for Summersville, WV residents who endure harsh weather conditions.

Uninsured/Underinsured Motorist Coverage

If you are involved in an accident with an uninsured driver, you are still covered financially under the motorist coverage. This policy ensures that you’re not put in a difficult position due to others negligence by providing the necessary protection from the uninsured drivers who cannot pay for the damages.

How to Get an Auto Insurance Quote from Erie Insurance in Summersville, WV

Requesting a Quote Online

One can easily get a quote for auto insurance from Erie Insurance due to the online service that the company offers. You simply need to fill in your vehicle, driving history, and other personal details. This is how you commence the process:

- Visit Erie’s website: Go to Erie Insurance’s official website.

- Enter your vehicle information: Enter the information necessary such as car make, model, year, and VIN details.

- Share your driving history: Provide any information regarding accidents, speeding tickets, and any insurance claims made.

- Get your quote: Once you have entered all your details, Erie will provide an estimate of your monthly premium.

Factors Influencing Your Auto Insurance Quote

Your auto insurance quote with Erie may depend on several factors:

Age and Driving Experience: Younger drivers or those without much driving experience may have higher rates. But older, more experienced drivers with clean records may enjoy lower rates.

Credit Score: Erie, like most insurers, considers customer’s credit history when setting premiums. Clients with better credit are more likely to be charged less.

Location: Summersville, WV, has its own regulations that, combined with the area’s accident history and local laws, can affect rates.

nderstanding these factors can help you develop effective strategies when selecting your policy.

Discounts and Savings

Erie extends a variety of discounts that can help you lower your auto insurance premium. Other discounts you might qualify for include:

- Safe Driver Discount: This discount is designated to drivers with clean driving records.

- Multi-policy Discount: If you combine your auto insurance with home or life insurance, you are likely to get a reduced rate.

- Anti-theft Device Discount: Vehicles equipped with an anti-theft system may be eligible for a discount. Such discounts greatly reduce Erie’s already low prices.

Erie Insurance Payment Options and Plans

Flexible Payment Plans

Erie provides various payment methods for your convenience which include the following options:

Monthly Payments: Split your premium into 12 equal monthly payments.

Quarterly Payments: Pay every three months for more both freindliens.

Annual Payment: Pay a yearly premium whichs comes with a minor discount.

Regardless of how you would prefer to structure payments, Erie offers options that make insurance easier to obt

Online Payment and Management

No one has made it simpler than Erie Insurance for you to manage your insurance policy. With Erie’s online platform, one can easily manage a mobile application with which you can pay your premiums, view your insurance coverage, manage even file claims. Privacy of knowing you can avail of your insurance needs whenever, wherever.

Erie Insurance Policy Features and Terms

Understanding Policy Terms and Limitations

When you are choosing an auto insurance policy, make sure to consider its terms and restrictions, as they are critical to understanding your coverage. Here are the key areas you should focus on:

Deductibles: A deductible is the amount of money you will have to part with before your insurance company sorts out the remaining expenses. Higher deductibles usually attract lower premiums but increases the amount you will pay in case you need to file a claim.

Policy Limits: Every insurance policy comes with a ‘cap’ and the amount of coverage that you can be offered is limited. In case of a significant collision, ensure to set the appropriate limits that will provide maximum coverage.

Exclusions: Insurance policies have gaps in coverage such as damage done on purpose or driving when drunk. Review your Erie Insurance policy document in detail so that you know the exclusions included in your coverage.

Policy Renewal and Adjustments

Your Erie auto insurance policy automatically renews at the completion of every coverage period. However, you may change your coverage at any point if your situation changes, for example you add a new vehicle to your policy or your rates change.

Providing Proof of Insurance

Just like other states in Summersville here in West Virginia, you must provide proof of insurance when law enforcement asks for it. Erie makes it convenient for its clients to view their insurance card through the mobile app or online.

Filing Claims with Erie Insurance

The Easy Claims Process

Filling a claim has been made super easy by Erie. You can submit a claim on their website or mobile app or even call a local representative. This is the procedure:

- Report the Incident: nt: Provide as much information as possible regarding the date, time and place of the incident.

- Submit Documentation: You will likely have to send images of the accident scene, vehicle damage, and even the police report if you have one.

- Track the Claim: Erie claims staff will facilitate your requests regarding the claim through the online portal.

Claim Processing Timeline

Erie’s estimate is that a claim can be expected to take a matter of days, although it could take longer in some cases. The adjuster will consider the information provided in the claim and contact you directly regarding any required additional information. He will later report the status of the claim through the portal.

You can also read Elephant Auto Insurance login and policy management

Erie Insurance’s Role in Summersville’s Community

Local Presence and Community Engagement

Erie Insurance prides itself on featuring prominently in local communities such as Summersville. They participate in local activities and promote good causes within the region. They, along with local agents and businesses, form strong bonds which enable better cohesion within the Summersville community.

Support for Local Events and Charities

Erie Insurance also takes part in the philanthropic endeavors of local events, charities, and other institutions in Summersville, further working towards betterment of the community.

Erie Insurance Reviews and Customer Testimonials

Customer Experiences and Satisfaction

Numerous peers have provided their positive feedback regarding the services offered by Erie Insurance. The firm has a reputation for helpful customer service, friendly claims, and low premium payments, which they do take advantage of. It is common for Erie to receive high marks for satisfaction, which makes it very sought after for auto insurance in Summersville, WV.

My Opinion| Why Erie Insurance is the Right Choice for Your Auto Coverage in Summersville, WV

Erie Insurance is known for their diverse car policies, offering something for everyone in terms of protection, pricing, and assistance. If you are an inexperienced driver, a veteran driver, or an individual looking to have the right coverage, Erie Insurance stands out as the best option in Summersville, WV.

Erie will help find the right coverage at the most affordable price for your needs. Start today by reaching out to an Erie Insurance agent for a quote!

1 Comment

View Comments